Med supp

Medicare supplement (medigap)

When Medicare was enacted as a law back in 1965, private insurance companies offered additional coverage to cover the deductibles and the 20% coinsurance that Medicare does not cover. These plans are called Medicare Supplement or Medigap. So, Medicare Supplements are a secondary insurance you can buy to cover some of the costs that Original Medicare does not cover. This means that you will have two insurance cards. Every time you see new providers, you will need to show your Original Medicare card and your supplement insurance card. Medicare supplement does not have a list of network providers. Original Medicare is your primary insurance and you are limited to providers that accept Original Medicare. You need to ask your providers if they accept Original Medicare before they give you service.

By Federal law, Medicare Supplements cannot be sold with Prescription drug coverage. Medicare Prescription Drug coverage (Part D) can only be obtain as a stand-alone plan offered by private insurance companies. If you buy a Medicare Supplement, make sure you also enroll in a prescription drug plan or you might be penalized later if you decide you want to get a drug plan. See my page on Prescription Drugs.

You can learn the ins and outs of Medigap from the Medicare publication “Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare”

Here, I want to highlight some important points:

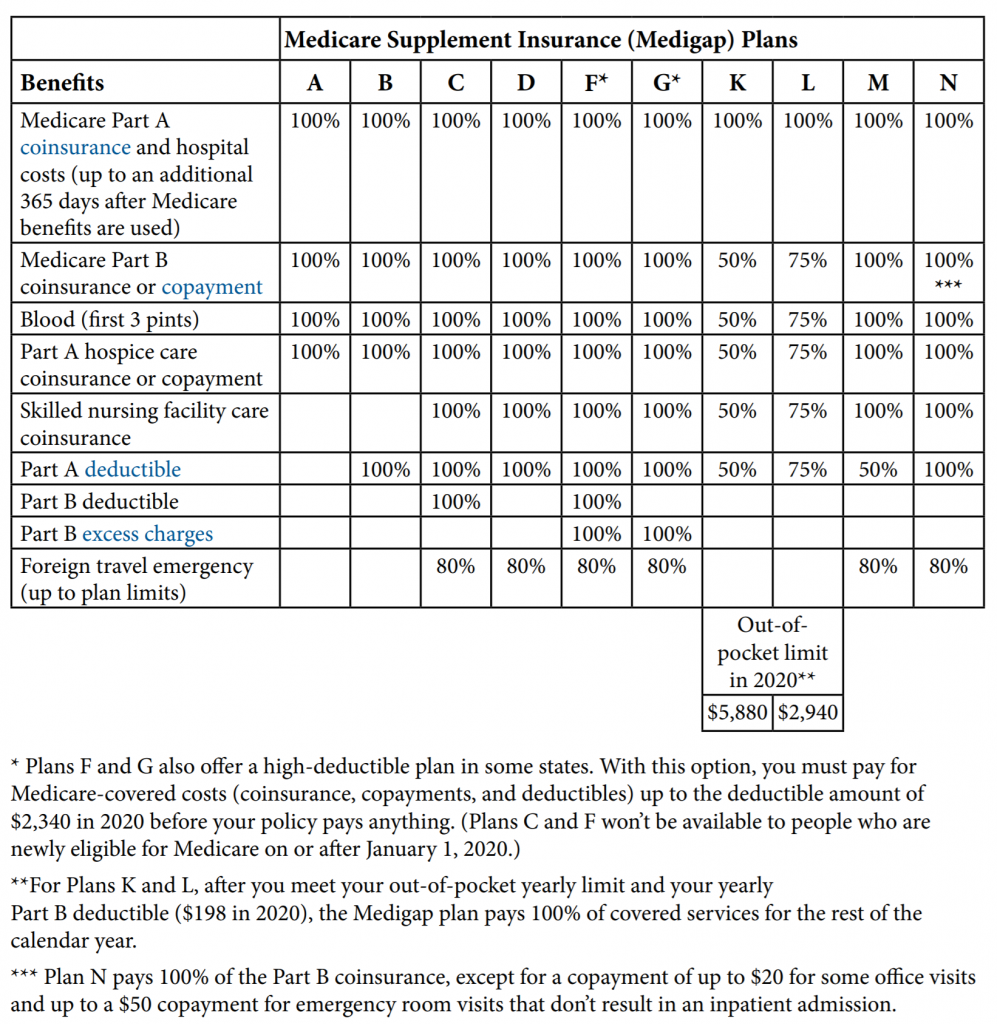

Medicare Supplement have different levels of coverage designated by letters (Plan A, Plan B, Plan C, etc.). Plan F can cover all the deductibles and all of the 20% that Medicare does not cover. However, if your Medicare started after January 1 of 2020, you are not allowed to sign up for Plan F. The plan with the most coverage for people that are new to Medicare after January 1 of 2020 is Plan G. Plan G will cover 100% of your Medicare out-of-pocket cost after you pay first the Medicare Part B deductible which is $198 in 2020. If your Medicare started before January 1, 2020, you are still allowed to sign up for Plan F. Some of the most common Medicare Supplement plans are Plan G, Plan N and high-deductible G. The following chart from the Medicare Publication Choosing a Medigap Policy shows the different plans and what they pay. The percentage shown in the box is the percentage amount the plan will pay:

The Medicare Supplement plans are standardized by Medicare. For Example, Medicare Supplement Plan G will have the same coverage with all companies that sell Plan G. Not all companies offer all plans. However, some plans might offer additional benefits like Gym Membership.

ENROLLMENT

Medicare Supplement have one Open Enrollment Period that allows you to enroll into the plan without medical underwriting. The Open Enrollment begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B and it last for 6 months. Companies are allowed to ask you about any pre-existing conditions and subsequently deny you coverage except during your Open Enrollment. There are other special circumstances when you are able to enroll in a Medicare Supplement without underwriting. They are referred as Guaranteed issue rights. Feel free to contact me to find out if a special circumstance can apply to you.

If you have employer health insurance, do not apply for Medicare Part B until you are ready to start using your Medicare Insurance. Medicare Part B is not useful while you have employer coverage. Also, your Medicare Supplement Open Enrollment Period might expire and you won’t be able to take advantage of enrolling in a plan without medical underwriting.

Medicare Supplement does not have annual enrollment periods. You are allowed to sign up and change your plan anytime during the year as many times as you wish. However, you may be subject to medical underwriting if your Medicare Supplement Open Enrollment has expired and if you don’t have a special Guaranteed issue right.

PRE-EXISTING CONDITION

If you develop a pre-existing condition after you have been enrolled in a Medicare Supplement, the insurance company cannot cancel your policy unless you don’t make a payment. You have 30 days grace period to pay your premium. If the payment is not received after your grace period is over, the company will cancel your plan and you will have to re-apply to get back on the plan. Some companies will make exceptions if an extra-ordinary circumstance prevented you from making the payment (For example, if you can proof that you were hospitalized and unable to send the payment).

One final point, Medicare Supplement plans premiums are adjusted annually. The older you are the higher the liability to the insurance companies; therefore, insurance companies will increase your premiums every year.

Get a Quote for a Medicare Supplement

There are dozens of Medicare Supplement companies. It is not practical for me to contract with all of them. The companies that I am currently contracted do offer very competitive rates.